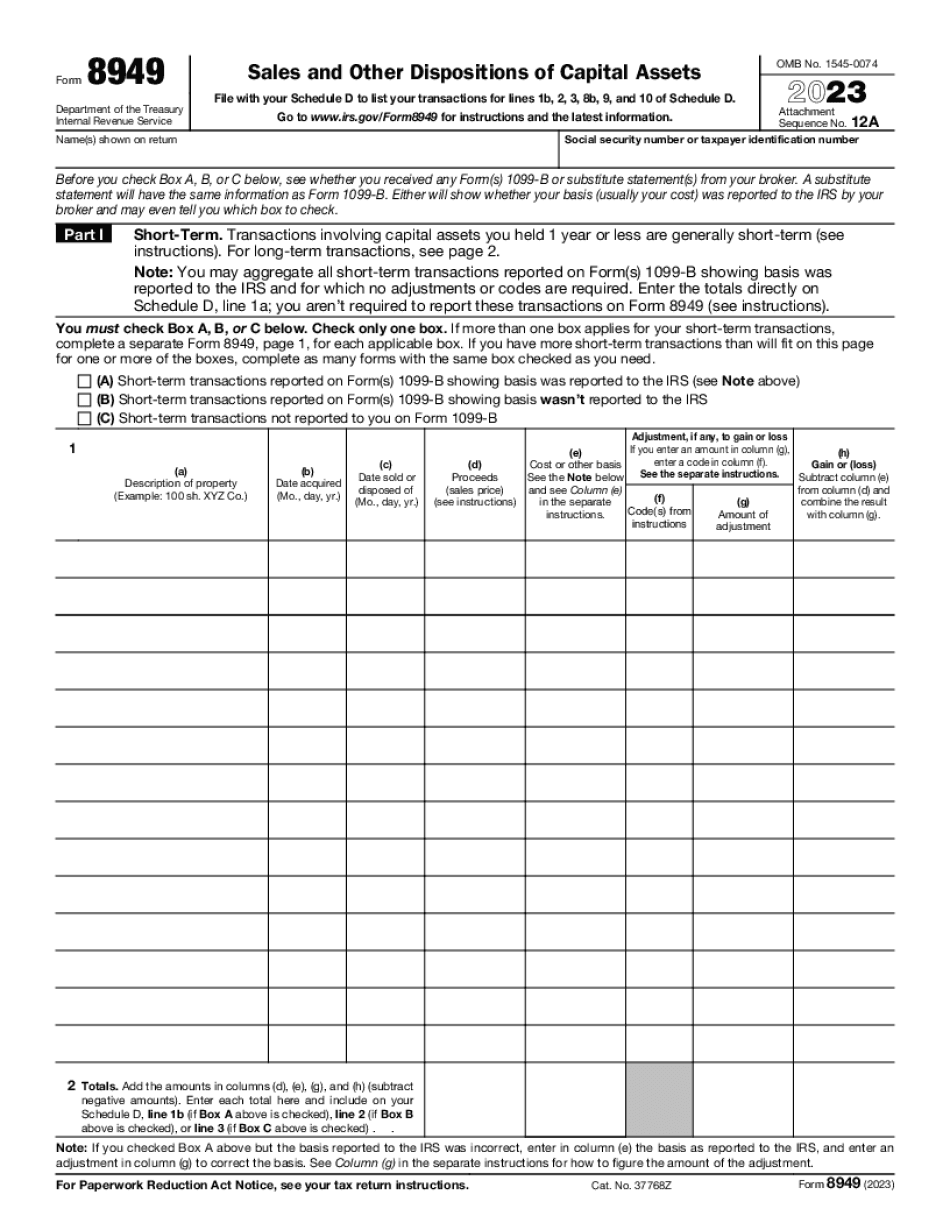

Form 8949 (Sales and other Dispositions of Capital Assets) 2023-2024

Show details

Hide details

He boxes complete as many forms with the same box checked as you need. D Long-term transactions reported on Form s 1099-B showing basis was reported to the IRS see Note above. For long-term transactions see page 2. Note You may aggregate all short-term transactions reported on Form s 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D line 1a you aren t required to report these transactions on Form 8949 see ...

4.5 satisfied · 46 votes

form-8949.com is not affiliated with IRS

Filling out Form Steps to Fill out 8949 Online online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guide on how to Form Steps To Fill Out 8949 Online

Every person must declare their finances in a timely manner during tax period, providing information the IRS requires as accurately as possible. If you need to Form Steps To Fill Out 8949 Online , our secure and intuitive service is here to help.

Follow the steps below to Form Steps To Fill Out 8949 Online promptly and precisely:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official guidelines (if available) for your form fill-out and precisely provide all information required in their appropriate fields.

- 03Fill out your template using the Text option and our editors navigation to be sure youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Make use of the Highlight option to accentuate specific details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or remove unnecessary file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal report delivery.

Choose the best way to Form Steps To Fill Out 8949 Online and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form Steps to Fill out 8949 Online ?

This Form is used to report to Employer the number of part-time employees and full time employees, including any student workers in the form of part-time students and other temporary workers in the form of temp and other workers under the Temporary Assistance for Needy Families (TANK) Program.

If you are reporting the number of full time employees, you must report the total number of employees, not just those who are full time employees, if they are reporting a “number of employees”.

What is the purpose of Form 8949 ?

This Form (and all Forms 4455 and 4457) are also used by the Internal Revenue Service to determine the credit amount of Form 1120S, which is used to reduce the maximum amount of federal income tax payable on the earnings of nonresident aliens who have been determined eligible to pay FICA. The credit is computed based on a formula. It is based upon the earnings of eligible nonresident aliens as determined under section 274A(a) of the Internal Revenue Code.

In addition to the reporting on this form, you must also report information regarding the hours of work, location, and pay.

When you file this Form 8949 online you can use the file option, which makes it easier to file and file automatically within a time limit. You may want to check with the IRS Tax Information Center about the current state of the file program to be sure that you are ready to file your returns by online filing.

You can use Form 8949 for any purpose, including:

Filing Forms 8949 with your employer;

Filling out a W-2 to report your wages;

Filing or making a statement with the Social Security Administration (SSA); and

Filing a claim for exemption under the Social Security program from filing federal income tax.

If you qualify for certain exemptions, you may want to file Forms 8949 and file your original, modified, or corrected income tax return using the Forms 8949 or W-2 instructions.

Additional Information

See the instructions on page 2 of Form 8949 for more information on reporting pay, hours worked, location and other reporting information.

Who should complete Form Steps to Fill out 8949 Online ?

If you use internet to search for car insurance quotes, you must be aware that the online services are quite expensive. Therefore, you must be careful, so you are not overcharged by the insurance company.

How does Form 8949 can be used to purchase car insurance? How does it work?

Online insurance car insurance quotes are available using the help of 8949 form. In this form you can check if the car insurance available from provider is the right one for your use. By filling in 8739 online insurance car insurance, you can use the same for the purpose of saving a large amount of money on car insurance.

Form 8949 should be finished by the time you arrive at the dealership as any errors must be fixed at the time of sale.

When the buyer arrives at the dealership, you can explain and explain to him and show him your evidence on the Form 8949 form. This form must be filled as the sales person is the one that will be carrying out the purchase, and he is the one the buyer has to pay.

Form 8949 is completed and a purchase receipt can be given to the buyer after completing a sale. In this form, it will be possible to show you what the car insurance you are buying will include. And to show the discounts offered at the time of sale.

Who should complete Form 8949 Online?

If you use internet to search for car insurance quotes, you must be aware that the online services are quite expensive. Therefore, you must be careful, so you are not overcharged by the insurance company.

If you do not have any car and do not need to buy a car yet, it is good idea to check and check the car insurance at the time you look online. In this case, you should complete Form 8949 before visiting the dealer.

It would be helpful to check with your family and friends as they will know if the car insurance you are signing is the right car insurance to buy.

Here is the list of things to note to complete the Form 8949:

You must submit the completed Form 8949 by fax or in person before the buyer arrives.

The Form 8949 must be completed and a purchase receipt is given to the buyer who will be the one who will purchase the car insurance.

The form is valid at the dealership or at the nearest office of the insurance company from where you would buy insurance. This ensures the lowest risk.

When do I need to complete Form Steps to Fill out 8949 Online ?

When you complete a FAFSA form, your school information will be saved electronically. It will not be sent back to you unless you request a hard copy of your FAFSA.

What is an FAFSA?

The Free Application for Federal Student Aid (FAFSA) is a federal student financial aid application. You can read more about the type of aid you receive, which types are available, the types of people who qualify, and the rules on benefits, costs, and deadlines under the FAFSA here.

The federal student financial aid application is what allows you to tell us about your financial circumstances (income, assets, and more). We use information from this FAFSA to determine your eligibility for federal student financial aid.

If I don't complete my financial aid application, how can I tell us my total financial aid eligibility (which categories of financial aid the money I receive may receive)?

You can see the full list of types of financial aid that may be available to you on the Free Application for Federal Student Aid (FAFSA) webpage. The only information we need from you is your FAFSA number and date of birth, so if you don't have or don't complete a FAFSA, you still may be eligible for financial aid. We'll let you know if you're eligible for financial aid based on your finances or family composition, and we'll try to find the best match.

Can I access my FAFSA information from the Internet?

You can also access your FAFSA information online. Visit FAFSA.gov/GetFSA for information on how to register for online access.

How will I receive financial aid if I fill out the Free Application for Federal Student Aid (FAFSA)?

If you complete the FAFSA by the deadline, or if you submit a Free Application for Federal Student Aid before August 10, 2018, we will begin to process your financial aid application. If you submit a Free Application for Federal Student Aid after August 10, 2018, you must submit your FAFSA by December 15, 2018, to have your financial aid decision mailed to you.

What information do schools need to look at to determine my eligibility and financial aid eligibility?

It depends on how your family makes money.

Can I create my own Form Steps to Fill out 8949 Online ?

The Online Registration process helps ease the process. The online register is an alternative to a paper form. The online register allows you to use an internet browser of your choice and is compatible with all modern browsers, including all those that have “JavaScript” disabled.

What should I do with Form Steps to Fill out 8949 Online when it’s complete?

Once the online enrollment has been completed, you receive another e-mail with a link that you need to click to log into Healthcare.gov. When you are ready to sign up for online coverage, go back to the enrollment tool and log in to Healthcare.gov again to complete the initial enrollment. You are now eligible to receive insurance coverage through Healthcare.gov.

How Do I Go Online After I Have Completed my Form 8949 to Get My First Health Insurance Payment?

If you have completed Form 8949 online, you will receive a unique ID when you access online Healthcare.gov. (You probably have received this online after the form has been completed. If you have received it after you have completed your actual Form 8949, make sure that the email address you used with your initial enrollment was the email you used for your initial enrollment, and is different from the one you used to complete your online Form 8949.

If you are having difficulty locating your unique online ID, contact the person who helped you with your initial enrollment.

How do I get my Form Steps to Fill out 8949 Online ?

I have tried all above-mentioned options, but all seem to be offline mode.

How do I get my Form 7974 Completed to my e-mail?

If you are from the USA and have used Google's form search, please check this link to find one that works.

If you have any questions on how to complete the form on Google form then feel free to e-mail them to me, and I'll assist you.

This form works best with Internet connection, but the data will get uploaded automatically with or without Internet connection as long as the data is saved by the form owner. In rare cases you may need to reload the form by clicking on “Next” button in one of forms. If you are on a mobile device you can download the form below for instant usage on the same page. It works best in Internet connectivity. Click here to download it.

1. Click this link to go to Google Form Home Page.

2. Click this link to go to Form Data.

(If you are on any other device please click the download link (above) to download the free form offline mode)

3. Click the next button in the same form to upload your documents.

Once the data gets uploaded your form will look exactly like a blank form, but it is actually filled out and ready to be used for a loan.

Please fill the following information on your online application in case you have any doubt. Also be sure to have your address, name and phone number as well as your application fee ready. Note that the Form steps is a one sheet form. Please keep it that way in terms of formatting and formatting only. Please check this link for some helpful tips:

4. Fill out your application form in order to submit the application.

You have now successfully completed the online loan application. Please wait for the process to start. The loan will now be assigned the loan application number which you can check to the right.

Step Three: Loan approval

When the loan application has been assigned the loan application number, it will email you. This email will contain the loan approval status which will be either completed, rejected or pending.

Important Notice:

You have to follow through with the loan once the application number (for your loan) has been assigned. This might seem a bit complex, but it really is not.

What documents do I need to attach to my Form Steps to Fill out 8949 Online ?

You may attach Forms AP-40, AP-41, or the appropriate portion of the VICAR, depending on the information you provided in the questionnaire/forms. This is done under the “additional attachments” feature.

Can I mail in completed applications to the IRS?

Yes, if you are filing an online income tax return (see questions 1.7 through 1.9 for more information).

If I want to complete step 8949 using my personal computer (PC) and I don't have an access card that I received when I applied for my VICAR to the IRS, is there a way to file the IRS tax return in paper?

Yes, you must check the “paper filing option” in your online Forms 8949 and fill out the VICAR forms online, using your information from your VICAR questionnaire. You are not qualified to fill out each of the tax forms on your own computer, you must have an VICAR access card to use the electronic filing option. Instructions for the electronic filing options will be provided as part of you refile email, and you must print and complete the appropriate file tax return. Forms 8949 will be mailed to you. A paper copy of your VICAR is required when you file Form 8949 using the file option.

How do I know which document is needed in my answer to Question 4 of Question 19?

If you have answered 3-5 or 1-3 on any questions in Question 19, the appropriate item for you to check on the Question 4 section of the document will be the second option, where the second item is “What document will you attach?”

Can I make changes to the answer to Question 4 of Question 19?

Yes. Please see instructions for Question 4, which are in “additional attachments.”

What happens after Step 5 is completed, and I complete the Form 8949 online?

Step 5 is done.

Is there a way to print and complete my completed Form 8949 during Step 5?

You cannot print and complete your completed Form 8949 during Step 5. However, if your application does not qualify or has been rejected on the basis of information provided in the questionnaires, we may ask you to submit additional documents before your application is processed. Please see instructions for Question 1.

What are the different types of Form Steps to Fill out 8949 Online ?

You can download the following Form Step sheet for download in full size version:-

How to fill out Form Step 8949 Online?

To fill out Form 8949 online, fill out the entire Form Step sheet (as below) then click on Download PDF. The PDF file will appear in your computer as a PDF document. You will need to convert the PDF document to a paper document by following the instructions given in the PDF file. You can either print the document, fax it to yourself, or copy the document to a blank, blank document and paste on this blank document.

Furthermore, you can fill the entire form in at once or copy and paste the document only where required.

After filling out form 8949 online, you can print it (only by printing one copy) or fax it to yourself (only by faxing the full-size copy to yourself). Note that the PDF file will be printed as a PDF file, and you may need to convert to a paper format.

How many people fill out Form Steps to Fill out 8949 Online each year?

Income and Income of Americans Form 8949 Total Number of Forms: 4,500,000 Income in each Filing Year: 8,900,000,000 Estimated Families with Individual Federal Tax Liabilities: 1,300,000,000 Families In Dependent Care: 694,000,000 Individuals In Age Groups Aged 0-17: 1,150,000,000

Total income estimates in this table are based on estimated family income, federal income tax liabilities, and the number of people in each age group who might have tax liabilities.

Is there a due date for Form Steps to Fill out 8949 Online ?

Is there a due date for Form Steps to Fill out 8898 Online ?

Is there a due date for Form Steps to Fill out 8749 Online ?

Is there a due date for Form Steps to Fill out 7949 Online ?

Is there a due date for Form Steps to Fill out 7095 Online ?

Is there a due date for Form Steps to Fill out 8091 Online ?

Is there a due date for Form Steps to Fill out 8081 Online ?

Is there a due date for Form Steps to Fill out 8028 Online?

Is there a due date for Form TD CAP 8501 Online?

Is there a due date for Form TD CAP 8802 (Online) ?

Is there a due date for Form TD CAP 8703 Online ?

Is there a due date for Form TD CAP 8703 (Print) ?

Is there a due date for Form TD CAP 8705 Online?

Is there a due date for Form TD CAP 8850 Online?

Is there a due date for Form TD CAP 19889 Online?

Is there a due date for Form TD CAP 9027 (Print) ?

Is there a due date for Form TD CAP 9217 Online?

Is there a due date for Form TD CAP 9401 (Print) ?

Is there a due date for Form TD CAP 9607 (Print) ?

Is there a due date for Form TD CAP 9602 (Print) ?

Is there a due date for Form TD CAP 9603 (Print) ?

Is there a due date for Form TD CAP 9604 (Print) ?

Is there a due date for Form T.C.A. 9206 (Online) ?

Is there a due date for Form T.C.A.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here